Advisor Portal: Unifying Tools, Insights, and Trust Through Design

Staff Product Designer

Q1-3 2017, Q3-4 2021

Product Strategy, Research, UI/UX design, Interaction design, Prototyping, User Testing, Training, Documentation

Role

As the financial industry grappled with the rise of roboadvisors, MyVest saw an opportunity to bridge automation and human expertise.

Challenge: Advisors were spending too much time on administration and too little time on clients.

Solution: I led the UX effort to design a scalable Advisor Portal—a platform that automated repetitive workflows, enabled collaboration, and empowered advisors to deliver personalized service at scale.

Impact: The new Advisor Portal reduced setup time for new households and portfolios to just two clicks, tripled advisor capacity, enabled cross-portfolio tax-loss harvesting that boosted engagement by 200% and activated over 10,000 accounts, cut non-revenue work by 50% through centralized workflows, and improved client retention by more than 70% with transparent, client-ready reports.

Product Designer (myself)

2x Product Managers

8 Frontend Developers

QA & Compliance

Sales

Customer Success

Team

“Thomas demonstrated an exceptional ability to translate complex problems into elegant design solutions, making the user interface a competitive advantage. He raised the bar in an industry that desperately needs it!”

Discovery

Rep as PM (Representative as Portfolio Manager) was beginning to gain traction in the WealthTech industry, signaling a shift toward empowering advisors with more direct control over client portfolios.

Our CEO, Anton Honikman, summarized the opportunity perfectly:

“People’s relationship with money is emotional. The algorithm alone is insufficient.”

This insight became the foundation of our design mission: create a digital experience that scales human connection.

To understand the true pain points, I conducted in-depth interviews with advisors and portfolio managers across institutions. What I learned was striking:

60–70% of their time was spent on non-revenue tasks.

Advisors juggled 200+ meetings annually.

Nearly half their day was consumed by administrative and investment management duties.

They weren’t just overwhelmed—they were underserved by their tools.

Ideation

Once I mapped out these inefficiencies, we ran affinity-mapping sessions to cluster themes and identify key opportunities. Personas were then crafted to represent our diverse advisor base—from independent wealth managers to those in enterprise firms.

Three design principles emerged:

Automate the repeatable.

Amplify the human.

Connect advisors to clients and home office seamlessly.

A competitive analysis revealed that existing platforms were either too narrow (focused on single accounts) or too rigid (lacking personalization). MyVest’s holistic data model offered a unique advantage—we could unify portfolios, households, and workflows under one intuitive interface.

Design

I collaborated closely with engineering to understand the limits and opportunities of our data aggregation layer. The design process unfolded iteratively:

Low-fidelity wireframes to test task flows early.

Interactive prototypes validated directly with advisors.

Data-driven refinement based on real usage feedback.

Our focus: a two-click setup for new households and portfolios, bulk workflows for tax-loss harvesting, and co-browsing capabilities for shared advisor–client sessions.

Every design decision came back to one question: “Does this help advisors spend more time on relationships and less on repetition?”

Usability Testing

We conducted multiple test cycles with advisors and internal stakeholders. Their feedback was direct and invaluable:

“This cuts my onboarding time in half.”

“Finally, I can manage all portfolios in one view.”

“The tax reports are a game-changer—I can show real value to my clients.”

Each iteration reduced friction and strengthened confidence in the platform’s usability and scalability.

Technical specifications and component testing

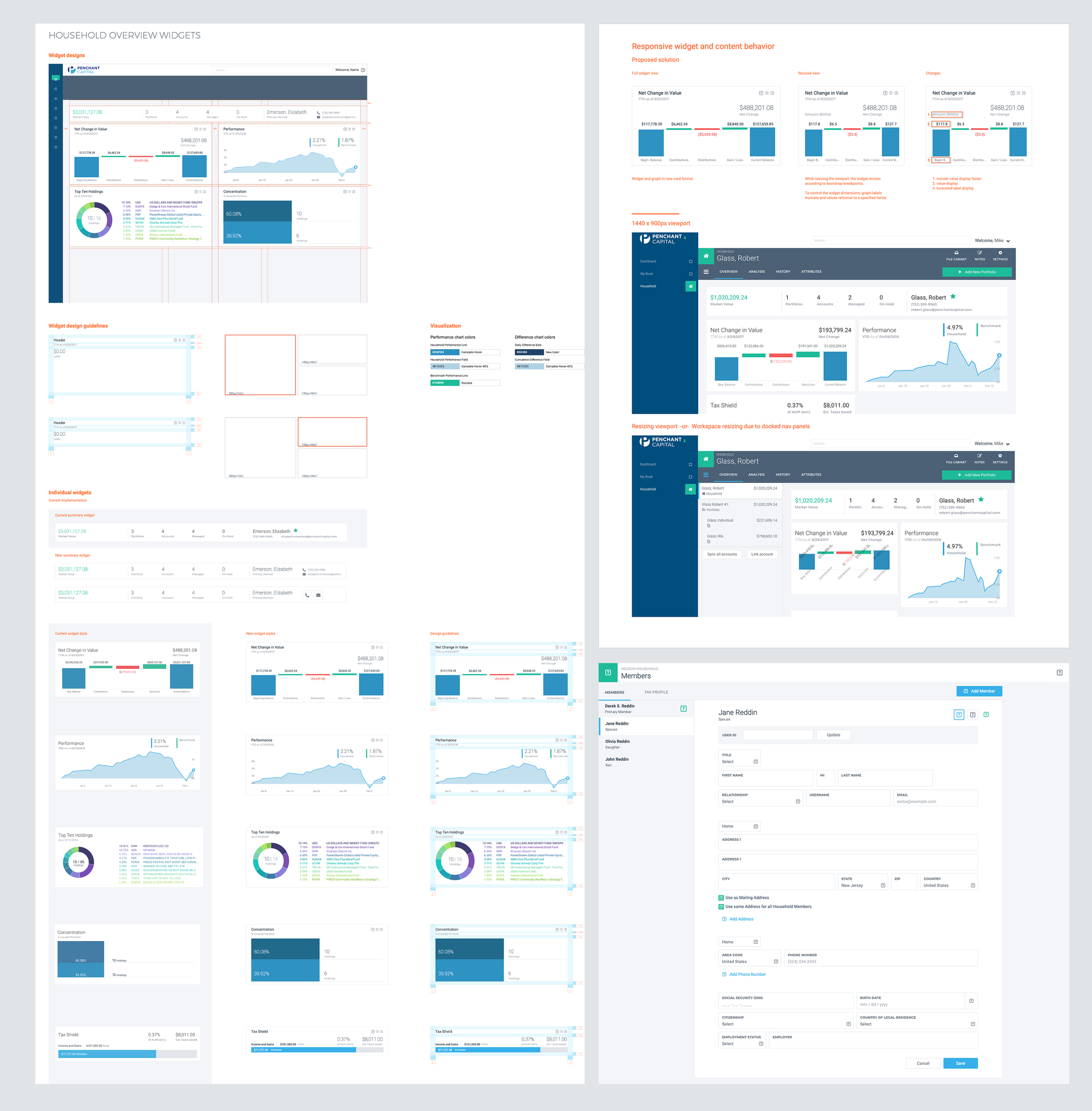

From Style Guides to Design System

Challenges

The biggest challenge was balancing technical feasibility with user ambition. Advisors wanted real-time, aggregated data across systems—an engineering and compliance minefield.

We addressed this by embedding engineers into design sprints and running feasibility workshops. These sessions not only clarified technical constraints but also opened new creative paths, such as partial data refreshes and asynchronous syncing for high-volume accounts.

Another challenge was stakeholder alignment. Each institution had different workflows and regulatory requirements. Maintaining a flexible, modular design system was critical to achieving buy-in and scalability.

Visualization of holdings

Improvements & Results

Within nine months, I shipped the MVP of the Advisor Portal—complete with co-browsing and multi-portfolio management.

Key outcomes:

Setup time for new households/portfolios dropped to two clicks.

Advisor capacity tripled as firms scaled teams to meet onboarding demand.

Tax-loss harvesting became cross-portfolio, increasing engagement by 200% and activating over 10,000 accounts.

Non-revenue work dropped by 50% through centralized workflows.

Client retention improved by 70%+ thanks to transparent, client-ready reports.

The platform not only improved efficiency—it elevated trust, personalization, and advisor confidence.

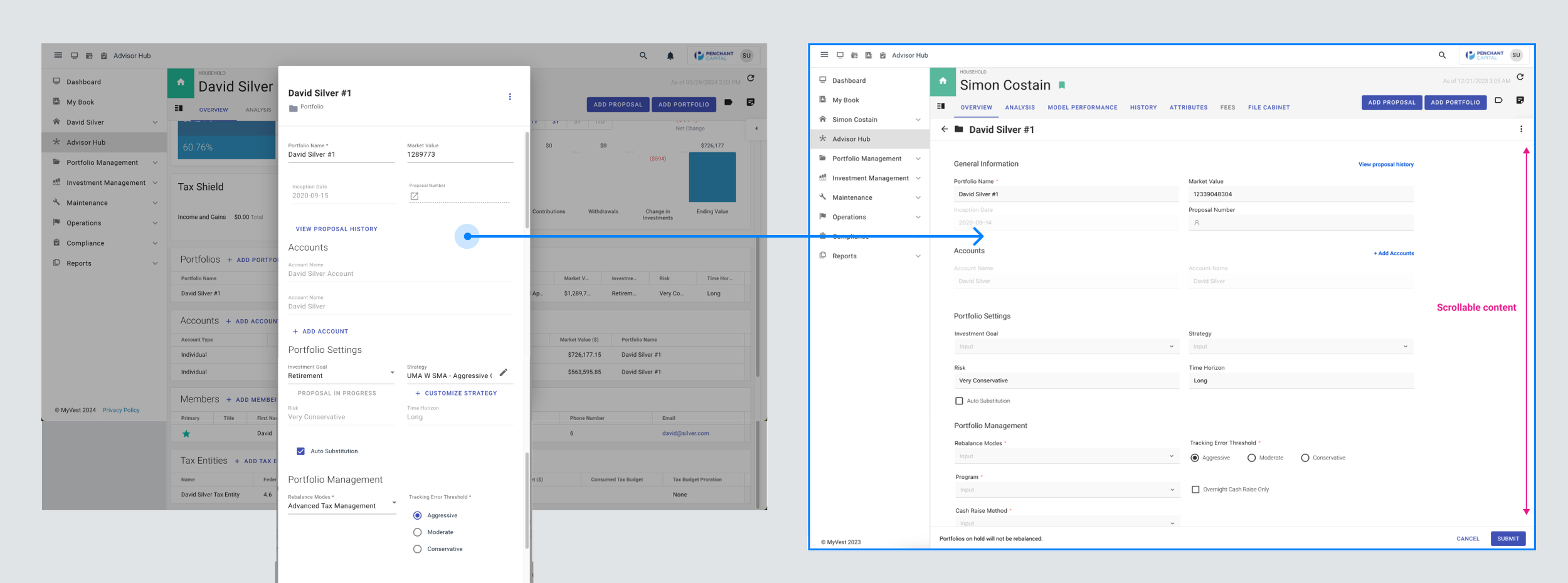

Continued improvements such as in-page editing

During testing, I learned that advisors preferred to stay focused on their workflow without jumping between pages. To support this, I removed the traditional side navigation and introduced an in-page browsing model.

Learnings

This project fundamentally reshaped how I think about the relationship between design, technology, and human value.

Discovery is where business value hides.

Interviewing advisors revealed inefficiencies that directly impacted profitability. Listening became a competitive advantage.Synthesis turns noise into insight.

Personas and affinity maps grounded my decisions in real needs—not assumptions.Design and engineering are partners in innovation.

Balancing ambition with feasibility created a product that was both visionary and deliverable.Iterate early, ship fast.

Delivering an MVP within nine months proved that momentum and adoption matter more than perfection at launch.Automation should empower, not replace, humans.

The ultimate lesson: efficiency creates capacity for empathy. By freeing advisors from administrative burdens, we allowed them to focus on what no algorithm can replicate—building human trust.