U.S. Bank - Streamlined Digital Onboarding Process

Staff Product Designer

Q1-3 2020, Q1 2025

Product Strategy, Research, UI/UX design, Interaction design, cross-functional Alignment, Prototyping, User Testing, Documentation

Role

Starting as a senior designer and then again as a staff designer, I led the redesign of U.S. Bank’s wealth management onboarding process within the MyVest SPS platform.

Challenge: U.S. Bank’s wealth management onboarding workflow was complex and inconsistent with its digital-first, client-centered promise. Advisors faced friction when creating proposed accounts and households, often needing to navigate redundant steps that delayed onboarding and discouraged platform adoption. This inefficiency limited asset-gathering efforts and slowed the time-to-advice for high-net-worth clients.

Solution: Mapped the end-to-end onboarding journey for both advisors and clients to uncover inefficiencies that slowed adoption.

Impact: 60% faster onboarding so advisors could create proposed accounts and households in a fraction of the time.

1 Product Designer (myself)

2 Product Managers

(MyVest + U.S. Bank liaison)

3 Backend Developers

2 Frontend Developers

4 U.S. Bank Advisors

1 Regional Director

QA & Compliance

Team

“The final prototype cut onboarding completion time by 60% and improved task accuracy by 40%.”

Discovery

The discovery phase began by interviewing advisors and reviewing real onboarding sessions. We mapped every step from initial client intake to account activation, documenting friction points such as redundant data entry, unclear validation messages, and compliance bottlenecks.

Cross-referencing these findings with 3rd party onboarding frameworks revealed opportunities to:

Automate repetitive steps through rules and triggers

Use data prefill and real-time validation to reduce human error

Synchronize advisor-led strategy development with digital processing

Ideation

Using these insights, I facilitated whiteboard sessions with advisors and product teams to visualize ideal workflows.

We sketched multiple variations of “create household” and “propose account” flows, testing trade-offs between speed, compliance, and personalization.

Key concepts emerged:

A single-point entry for new clients and households

Progressive disclosure of fields based on account type

Automated data checks to ensure compliance alignment before submission

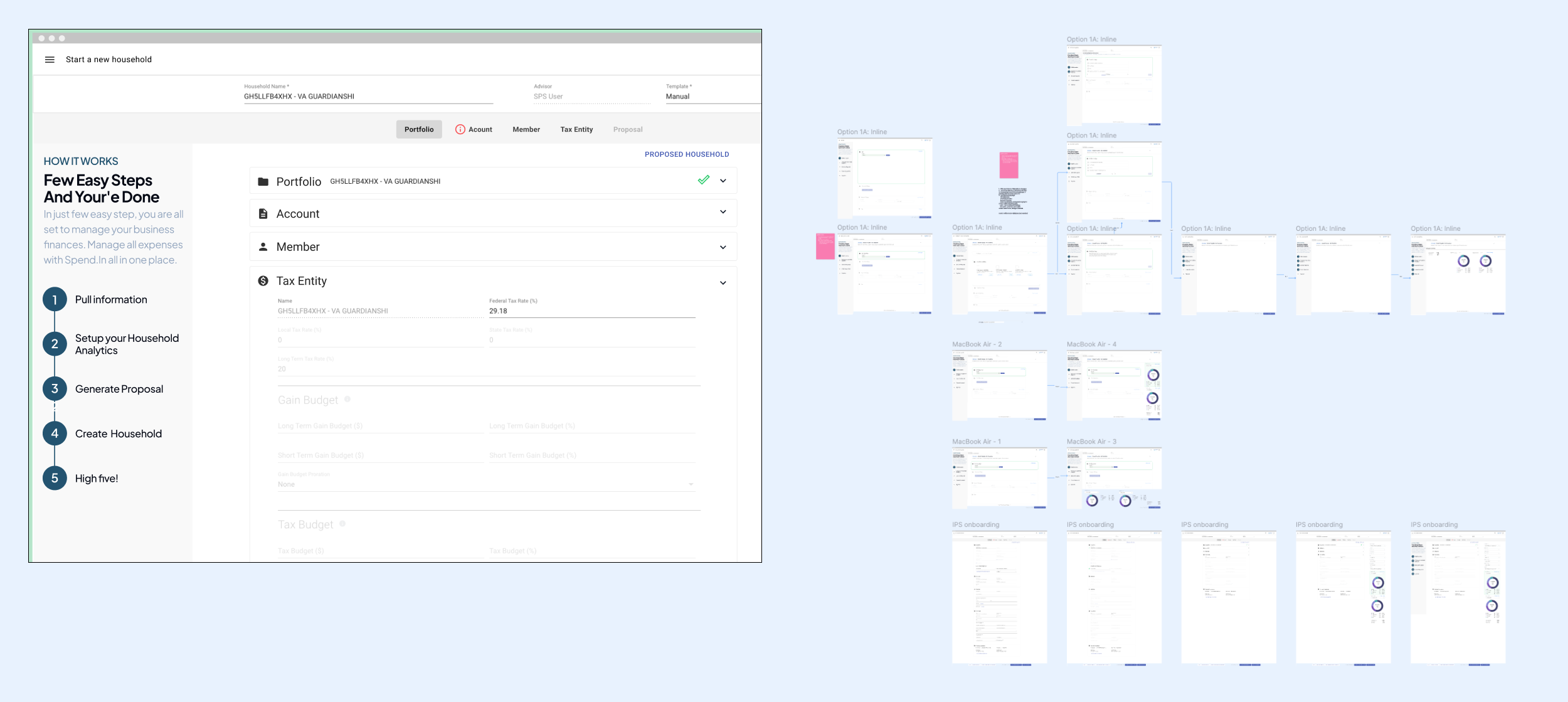

Designing a vertical long form

Long form with multiple setup integration points and requirements

Design

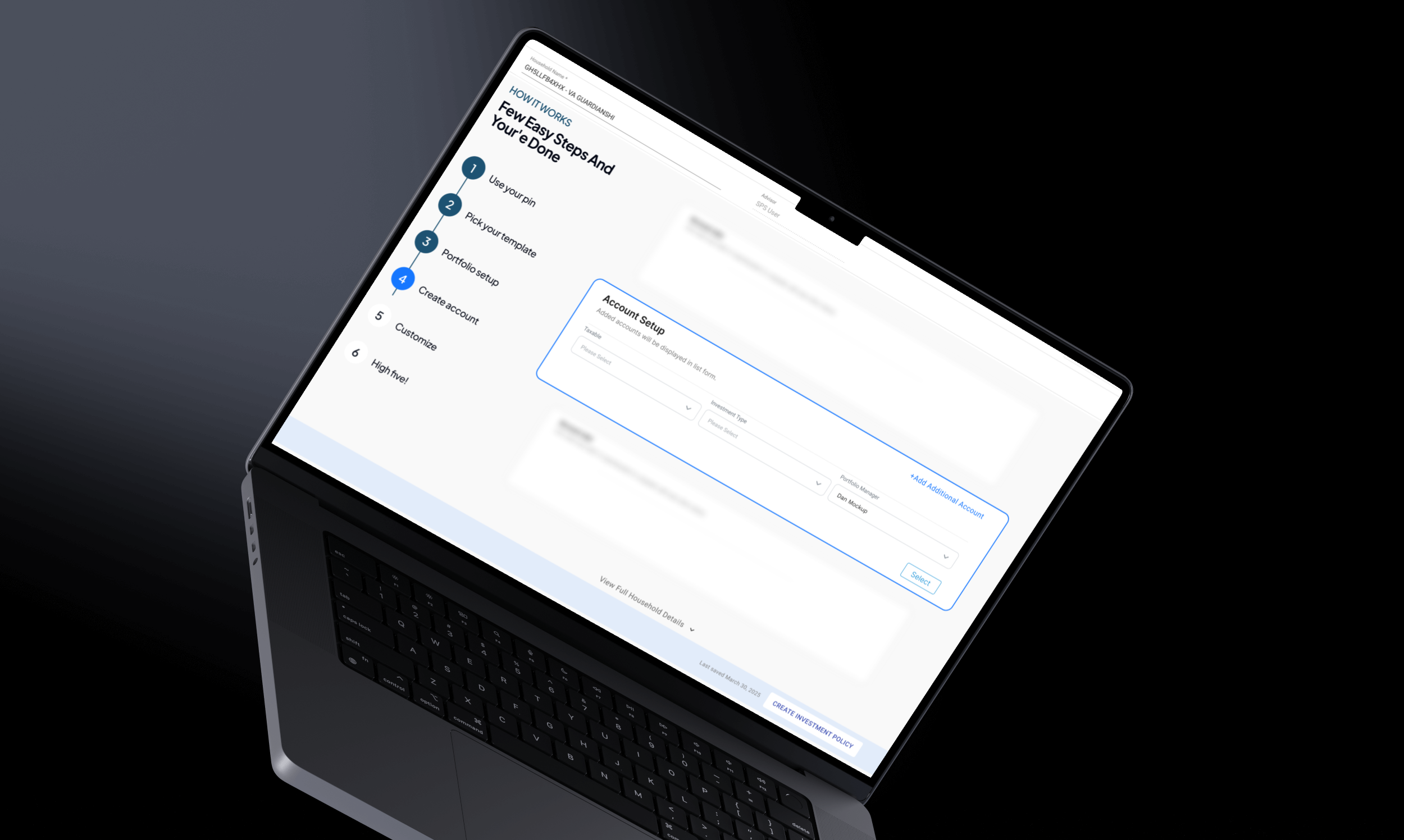

The final design translated these ideas into intuitive, modular workflows that supported advisor flexibility while maintaining process control in a vertical and a horizontal format.

Simplified navigation: Consolidated multi-screen forms into guided steps.

Dynamic logic: Used rules-based prompts to reveal only relevant information.

Visual feedback: Introduced contextual validation and progress indicators for clarity.

System alignment: Ensured design compatibility with Salesforce’s Digital Client Onboarding modules for data sync and workflow automation.

Each design decision reinforced U.S. Bank’s dual goal — digital simplicity with human connection.

Usability Testing

I conducted multiple testing rounds with U.S. Bank advisors and internal QA testers.

Round 1: Focused on clarity and task completion time.

Round 2: Measured error frequency and user confidence.

Round 3: Validated compliance edge cases and Salesforce data syncs.

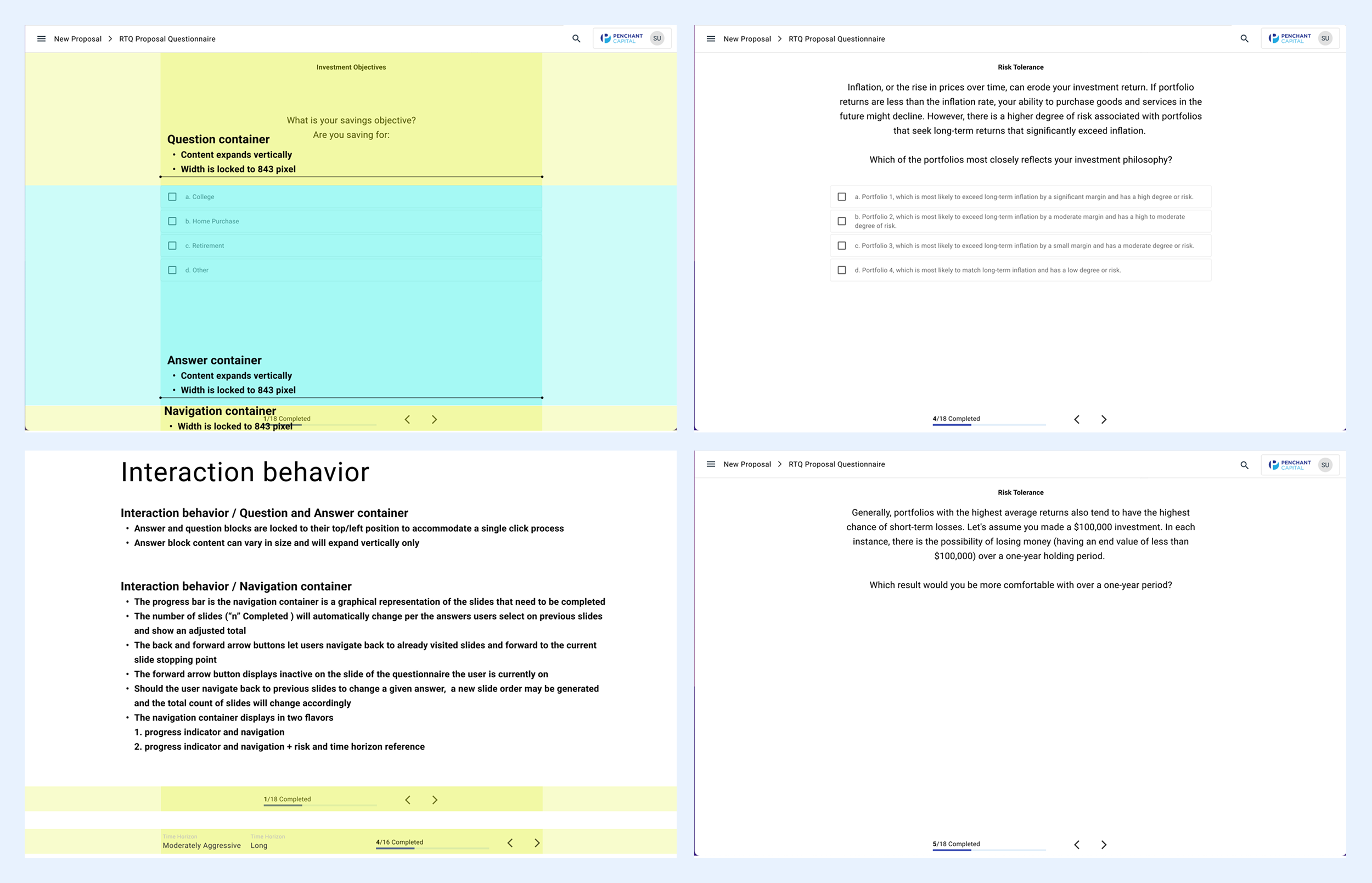

Feedback guided refinements such as clearer error states, reduced field redundancy, and improved contextual help. The horizontal layout was a clear winner over the vertical long form.

Questionnaire in horizontal format

Challenges

Balancing compliance with usability: Ensuring the process met regulatory requirements without overloading advisors.

Integration constraints: Aligning MyVest’s data structures with Salesforce’s onboarding schema required close technical coordination.

Change management: Advisors accustomed to manual workflows needed onboarding and support to adopt digital-first habits.

Improvements

Introduced step-based progress tracking to maintain advisor awareness.

Added real-time Salesforce integration for instant status updates and approval syncing.

Implemented role-based access controls to protect client data and streamline collaboration.

Result

60% faster onboarding: Advisors could create proposed accounts and households in a fraction of the time.

Improved adoption: Advisors quickly embraced the streamlined SPS experience, prompting U.S. Bank to triple its advisor headcount to meet demand.

Operational accuracy: Rules-driven workflows reduced manual errors and compliance issues.

Enhanced brand trust: Clients experienced a smooth, transparent onboarding journey aligned with U.S. Bank’s commitment to personalized digital wealth management.

New business opportunities: MyVest leveraged this success to secure further development partnerships with U.S. Bank.

Learnings

Deep workflow understanding is the foundation for simplifying complexity.

Cross-functional collaboration bridges the gap between usability and compliance.

Rules-driven design increases accuracy, efficiency, and user confidence.

Design drives business outcomes: Streamlining onboarding accelerated U.S. Bank’s asset-gathering and strengthened trust in digital processes.

Human touch remains essential: Even in automated environments, preserving advisor involvement ensures client satisfaction and loyalty.